PT SUNRISE BUMI SR 2019-21

PT INDO LIBERTY TEXTILES SR 2019-20

ABG DOMESTIC TEXTILES SR 2019-21

INDO THAI SYNTHETICS SR 2019-21

PT ELEGANT TEXTILE

KOEL Sustainability Report 2019-20

Yes, the Responsibility of IR is with the Governance Body- Revised IR Guidelines

The International Integrated Reporting Council (IIRC) on19 January 2021, published revisions to the International <IR> Framework to enable more decision-useful reporting.

According to the IIRC press release “The revisions, the first since the <IR> Framework was originally published in 2013, are the result of extensive market consultation with 1,470 individuals in 55 jurisdictions. The consultation demonstrated that the conceptual thinking and principles of the <IR> Framework remain fit for purpose and robust, as evidenced by the 2,500 organizations in over 70 countries that use it”.

“As business resilience is tested so severely in the wake of the global pandemic, climate change, and growing inequality, effective integrated thinking and reporting is more important than ever. We believe these revisions can help businesses deliver more robust, balanced reporting. The revisions are also aligned with our efforts to develop a global, comprehensive corporate reporting system.” as said by Charles Tilley, CEO, IIRC.

The IIRC launched the revision process in February 2020 and addressed three key themes of the revision: a) business model considerations, b) responsibility for an integrated report, and c) charting a path forward. The third theme was intended to inform the IIRC’s longer-term strategy.

An integrated report tells the overall story of the organization. It is a report to stakeholders on the strategy, performance, and activities of the organization in a manner that allows stakeholders to assess the ability of the organization to create and sustain value over the short, medium, and long term.

Salient changes in the Revised <IR> Guidelines –

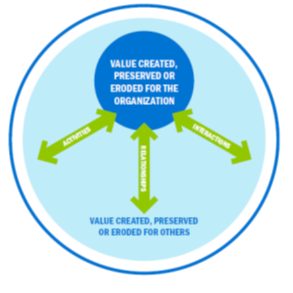

1. Value Creation includes Preservation and Erosion

It is now explicit and presented at all relevant places that the value creation includes preservation and erosion. Thus, the revised guidelines (section 1.7) states that – “The primary purpose of an integrated report is to explain to providers of financial capital how an organization creates, preserves or erodes value over time. It, therefore, contains relevant information, both financial and other”.

Accordingly, Figure 1 in the guideline also has been changed to:

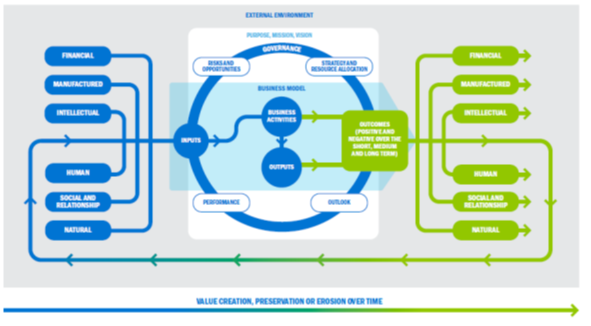

2. Value Creation Model elucidates Better

Similarly, the Value Creation Model is explicit in –

a. Elucidating the relationship between capitals, inputs, and outputs.

b. The outcomes are not only direct consequences of outputs but can also be the result of business activities. This illustrates how outcomes can impact the state of output capitals and in-turn the input capitals.

c. Explicit recognition of positive and negative outcomes in the short, medium, and long terms in line with value generation, preservation, and erosion.

“We continue to urge companies to adopt balanced capital plans, appropriate for their respective industries, that support strategies for long-term growth…. Generating sustainable returns over time requires a sharper focus not only on governance but also on environmental and social factors facing companies today. These issues offer both risks and opportunities, but for too long, companies have not considered them core to their business – even when the world’s political leaders are increasingly focused on them, as demonstrated by the Paris Climate Accord. Over the long-term, environmental, social and governance (ESG) issues – ranging from climate change to diversity to board effectiveness – have real and quantifiable financial impacts… letter sent by BlackRock CEO Larry Fink to the CEOs of the S&P 500”.

3. Responsibility for Integrated Report

In section 1.20, of the revised guidelines, the responsibility of the Integrated report is set on those who are charged with governance.

“An integrated report should include a statement from those charged with governance that includes: –

a. An acknowledgment of their responsibility to ensure the integrity of the integrated report, and,

b. Their opinion or conclusion about whether, or the extent to which, the integrated report is presented following the <IR> Framework”.

This is a continuation of the agenda set in 2013 guidelines, wherein an option was given till the 3rd integrated report.

In summary, the revised guidelines are explicit and clear on the definition of value creation, interlinks amongst capitals, and finally the outcomes. The responsibility of integrity if the Integrated Report and the Report is prepared as per IR framework is set on the Board in the revised guidelines.

DJSI/CSA 2020 Update

On Wednesday 1 April, the annual Corporate Sustainability Assessment begins. The S&P questionnaire will be open for filling in. As you know, this is the basis for selecting the best-performing companies for the Dow Jones Sustainability Index (DJSI). S&P Global assesses, each year, over 7,500 companies around the world on industry-specific and financially material ESG topics. Be ready and as a first step, check out the summary of changes for this year’s methodology.

This year’s most important changes are

- New or modified queries on

- Privacy Protection is covering companies’ privacy policies and the mechanisms in place to ensure their effective implementation. Furthermore, breaches of customer privacy are to be mentioned

- Information Security & Cybersecurity focuses on companies’ preparation to prevent major information security/cybersecurity incidents and past incidents and financial implications

- Sustainable Finance: In project finance, the criterion of 5% of revenues has been removed. Now you can give a breakdown of ESG products and corresponding volumes that these products represent.

- Innovation Management: ‘R&D Breakdown by Innovation’ can now be mentioned

- Product Stewardship: Now you have to provide the amount of packaging material used as well as the percentage of recycled packaging. Also, queries on companies’ packaging strategies are included. For Hazardous Substances, companies now have to provide their revenues from products that contain these substances.

- Genetically Modified Organisms: This criterion is updated for disclosure on the company’s GMO exposure, the company’s public statement on GMOs, and the percentage of revenues derived from GMO products.

- Access to Cost Burden: The query on fair pricing for Drugs and Pharmaceuticals is shortened and now only focuses on the weighted percentage year-over-year change in the average list price and the average net price.

- The questions on quantitative data within Environmental and Social Reporting are deleted for all industries.

- The criterion of Supply Chain Management is no longer applicable to the Professional Services (PRO) industry.

While assisting companies in Corporate Sustainability Assessments and Disclosures, RSM GC adopts a practical, hands-on, year on year approach that leverages the existing performance and identifies opportunities for strategic development in the future.

Are Global Carbon Markets Reviving?

Don’t expect a straight answer. The best answer is -there is an increased intensity of noise and buzz around carbon credits generated under the Clean Development Mechanism. Many trade inquiries for CERs have origin in the expected gap in CER quota in the EU Emission Trading Scheme. Such trade inquiries may be transient but more significant signals for hope in the revival of global markets are – (i) actions by many countries around Article 6 of the Paris Climate Agreement, (ii) US Presidential elections’ outcome, and (iii) independent and voluntary private-sector commitments to meet the ambitions of Paris Climate Agreement. These amongst others are reasons for the positive buzz around Global Carbon Markets.

Coordinated Response on Climate Change Matters

Nearer home, the Government of India on November 27, 2020, through a gazette notification, has constituted the Apex Committee for the Implementation of the Paris Agreement (AIPA). The Constitution of this committee would not have come at a more appropriate time or could not have been timed better. Earlier this month, the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) has released its first consultative document[1]. TSVCM is a private sector-led initiative working to scale an effective and efficient voluntary carbon market to help meet the goals of the Paris Agreement.

AIPA and Carbon Markets

AIPA of Government of India has been constituted with the purpose of “ensuring a coordinated response on climate change matters that protects the country’s interests and ensures that India is on track towards meeting its climate change obligations under the Paris Agreement including it’s submitted Nationally Determined Contributions (NDCs)”[2]. Most importantly, the AIPA will also act as a national authority for the regulation of carbon markets in India under Article 6.2, Article 6.4, and Article 6.8 of the Paris Agreement. Constitution of AIPA and mention of carbon markets in its mandate, a signal for internal carbon markets in India to facilitate achievement of NDCs? -not clear. But AIPA’s work will be crucial for India and its position vis a vis rollover of CERs into Paris Climate Agreement, in the previous COP 25 at Madrid, Spain.

Recall the issues raised by India and other developing countries in Madrid. India and many other countries vehemently argued that not valuing the CERs post-2020 under the UN-mandated sustainable development mechanism will send a wrong signal to private players who invested in them. The rollover credits amount to 4.65 Gt CO2 carbon offsets, largely allocated to China, India, and Brazil. Such rollover may pose threat to the challenge of achieving climate ambition. However, not rolling over would mean breaching the trust of many public and private players that have invested into the GHG emission reduction projects which “would not have happened otherwise” or “were not financially viable”. AIPA would play an important role in the negotiations and maintain a fine balance between shoring up trust in climate mechanisms (realize the value for carbon offsets that were generated under the Kyoto Mechanisms) and integrity of Article 6 of the Paris Climate Agreement.

Private Sector Voluntary Initiatives in Carbon Markets

AIPA, in playing its role as Carbon Market Regulator and Promoter, may keep a close watch on Private Sector Voluntary Initiatives in Carbon Markets and dovetail that smartly into Paris Climate Accord and market mechanisms therein. The private sector-led initiative, the Taskforce on Scaling Voluntary Carbon Markets, is working to scale an effective, efficient, and functioning voluntary carbon market to help meet the goals of the Paris Climate Agreement. The Taskforce was initiated by Mark Carney, UN Special Envoy for Climate Action and Finance Advisor to UK Prime Minister Boris Johnson for COP26 is chaired by Bill Winters, Group Chief Executive, Standard Chartered.

The Taskforce was convened in September to quickly draft a set of practical recommendations to develop a well-functioning voluntary carbon market. A large, transparent, verifiable, and robust voluntary carbon market will be critical to reaching net-zero and net negative goals.

The Consultation Document outlines 17 recommendations, spanning six topics, to scale voluntary carbon markets; these topics include a proposed set of principles (core carbon principles) that would help establish standardised benchmark contracts that would be listed on exchanges and utilise existing infrastructure. The Taskforce will seek consensus on the legitimacy of offsetting, on steps to develop certainty regarding market integrity, and on ways to establish best practices for buyers and investors.

Kyoto Carryover Could Cancel Out Key NDC Ambition?

Would AIPA consider and integrate private sector initiatives into its plans of using global market mechanisms for achieving NDCs? Or it would essentially limit itself to advancing arguments for simple rollover of generated CERs and adversely affect the ambition of the Paris Climate Agreement? Above all, AIPA could surprise everyone by leveraging rollover or retiring of CERs for generating climate finance to fund action to achieve climate ambition by developing countries.

[1] You can provide your inputs to the consultative document till December 10

[2] The three quantitative goals in the Indian NDCs are:

- A 33-35 per cent reduction in the gross domestic product emissions intensity by 2030 from 2005 levels,

- A 40 per cent share of non-fossil fuel-based electricity by 2030, and

- Creating a carbon sink of 2.5-3 billion tonnes of carbon dioxide through afforestation programmes